Will Amazon’s first phygital clothing store, Amazon Style, encourage a shakeup in other CPG categories? We know from covering retail for decades that what starts in one category extends to other, unexpected areas, so we sent our retail scout to explore. Here’s what she learned.

Amazon Is Ready to Restyle Retail, Again

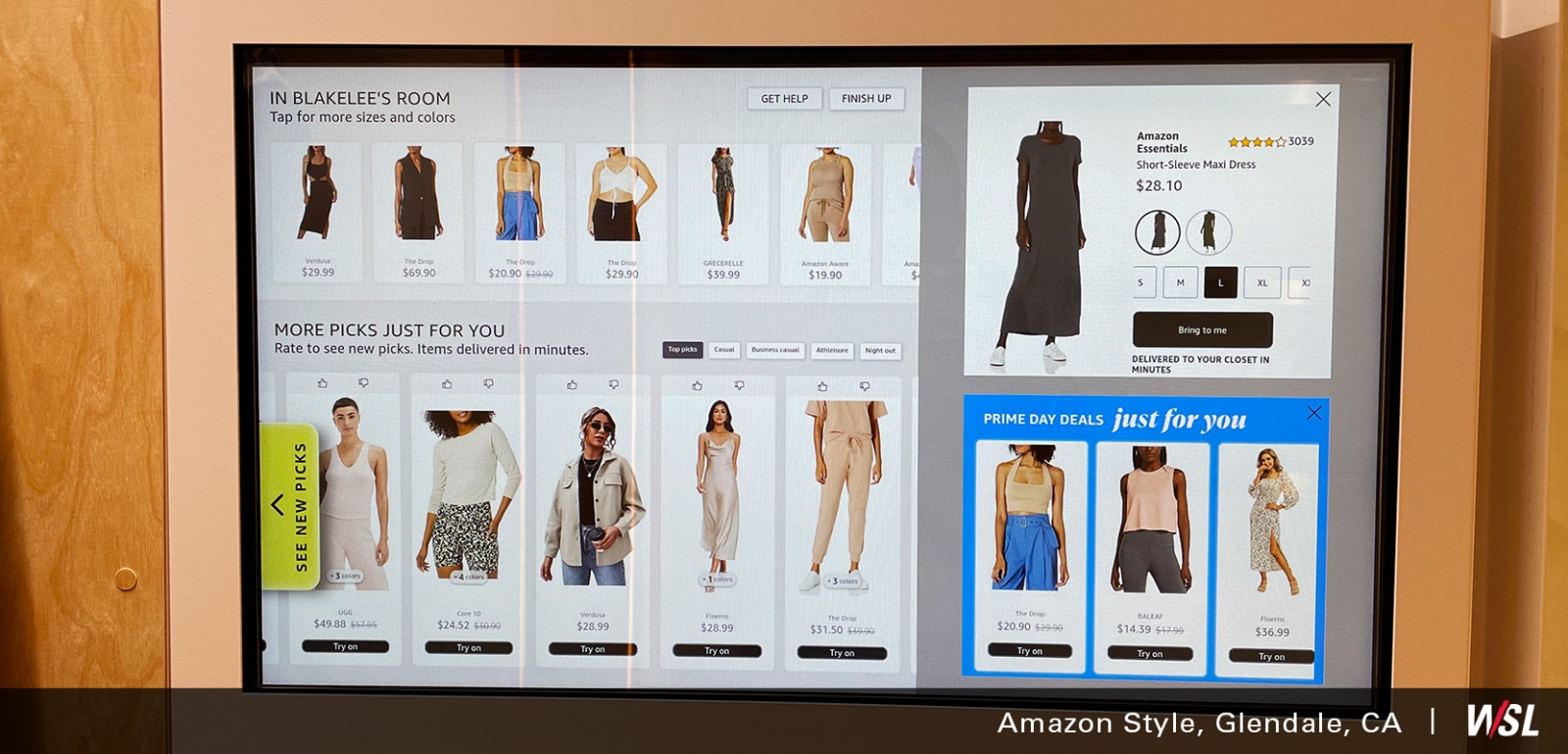

The premier of Amazon’s first physical clothing store, Amazon Style, introduces shoppers to what’s next in clothing shopping – a “phygital” blend of brick and digital best practices. Pick the items you want, find them waiting in an assigned fitting room, pay online (if you want). No need to run out of the dressing room for more sizes because you can order them on an in-room digital screen and an associate will bring them to you, no carts to push, no lines.

Depending on how shoppers respond, the format might become the template for apparel stores and retail in general. We know that clothing retail is often a catalyst for change across the broad retail spectrum, from sporting goods to home decor.

The Amazon Style Retail Safari®: Our Takeaways

We sent one of our Retail Safari® scouts to Amazon Style in Glendale, California, to document what a shopper will experience. Here is what we think works, and what needs work.

What Works at Amazon Style:

- Overcomes digital unease. Amazon Style helps shoppers unsure of purchasing clothing online to try on their Amazon favorites in a physical setting, giving them confidence in the sizes and styles to order online next time.

- Less schlepping. Our scout, Blakelee, didn’t need to schlep an armload of clothing through the store. She simply scanned the QR codes of items she liked, selected the colors and sizes available and received them at an assigned fitting room, where an associate delivered them.

- See the viral fashion trends. Amazon Style brings the viral hits on TikTok and other social feeds to life. Some displays are based on themes, such as the Y2K (styles from the 1990s.). Other displays feature “The Graphic Tee Edit” and “Feminine Strength.” Some QR codes on clothing displays advise interested shoppers to “shop this look” by screening the code and browsing similar styles online. Hashtags on the walls entice shoppers to share their finds.

- Browsing is digitally personal. When shoppers enter their assigned fitting rooms, they’re welcomed by digital screens that display their name and suggest clothing items similar to those selected, which can be quickly delivered to their room by an associate. In-store signs alert shoppers to how easy it is to try more, bringing the ease of adding more to the cart, typical to online shopping, into a physical store.

- The human element remains (for now). One of the advantages of visiting a store is assistance from knowledgeable, smiling sales associates. Our scout was approached by helpful employees throughout her trip. Will Amazon Style sustain this helpful, friendly culture?

- Price points for everyone. Shoppers of all budgets can find something in this store, from $20 tops from Amazon’s in-house collections to a $200 dress by designer Norma Kamali.

What Doesn’t Work:

- The anti-social boutique. While there is plenty of staff, they are engaged in tasks, not personal contact. Amazon Style’s frictionless technology removes some human elements, such as an employee to offer feedback on how something looks. As shopping becomes increasingly contactless, these small pleasures should be kept in mind.

- It’s not all quick. Although the fitting room process was fast, our scout found the store had too many displays and curated choices, many of which blend into each other, to easily navigate on a time crunch. Shoppers looking to grab a quick staple item might feel overwhelmed.

- Requirements to shop: Amazon account and a smartphone. In order to shop Amazon Style, you must have a smartphone and an Amazon account. The store provides plenty of chances to sign up for an Amazon account via the clothing QR codes, but one has to have a smartphone to do that.

What a Wide-Spread ‘Style’ Change Will Require

These takeaways are instructive fodder for other retailers, particularly those in categories where shoppers like to touch and feel the merchandise.

So let’s look around the corner at what’s next. Amazon has yet to shake up the grocery category – its Amazon Fresh and Whole Foods formats are familiar, with little innovation. Its Style store is testing the waters for a phygital format, starting with clothing.

We’ll be looking to see how shoppers respond and where it will go next.

WSL Strategic Retail has been exploring what’s new and what’s next in retail since 1986. To learn more about how our Retail Safari® can guide your more profitable future, access our Retail Safari® fact sheet here.