Retailers have been experimenting with added services to appeal to hurried shoppers for years, but these latest innovations, explored by our Retail Safari® scouts, offer fresh insights. Here’s a sampling of added in-store features at Boots, Walmart and Petco, and how to deal with the critical real estate question.

The Hot New Retail Category? Tailored In-Store Services

Non-retail customer services are not new to retailers. Innovative leaders have been experimenting with added services tailored to shifting shopper preferences for years, as evidenced by our documentation of retail’s ambitious expansion into wellness and healthcare, for example.

Not all such efforts have a shelf life, however, and over the years our Retail Safari® scouts have kept tabs on which innovations have legs, and which have fallen short.

In 2024, our scouts continue their exploration, visiting retailers that have added inventive in-store services and experiences designed to meet their customers’ specific needs now, and tomorrow. Here’s a free sampling for you.

Innovations In-Store – By Boots, Walmart and Petco

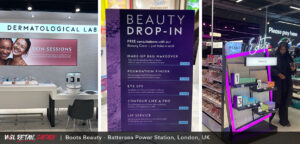

Boots Pharmacy goes full beauty.

UK’s largest pharmacy chain has the recognition and scale to take chances on its beauty category. So after having renovated 170 of its in-store “beauty halls,” Boots has opened a beauty shop without a pharmacy. Wellness still plays a role, however. Boots Beauty applies the retailer’s considerable authority in healthcare to its beauty products and services. The selection is focused – scientifically endorsed, dermatologist-tested skincare products – yet includes options across all price points so all shoppers feel welcome (think Olay to Dior). It’s beauty services, too, meet all budgets: high- or low-tech, speedy or leisurely, free or paid. Shoppers can get free 15-miniute “Beauty Drop-In” services or paid dermatology treatments, all administered by the Boots Beauty Crew and dermatology-trained pharmacists.

Petco brings humanity to a four-legged destination.

In 2023, Petco opened a total-care location in Union Square, NYC, that services the needs not just of pets, but their owners. The multi-level store is laid out so pet parents can easily get where and what they need. Services such as grooming are smartly on the ground floor, knowing shoppers might want to drop their pet off while en route to another commitment, just beyond are easy-to-grab pet shampoos and accessory displays. The store also serves as a testing ground for a shop-in-shop Reddy boutique, Petco’s in-house eco-friendly brand (bonus: a space where shoppers can personalize pet clothing). Similarly, Petco houses its pet “home” category as shop-in-shop destination. Throughout, messaging includes human wellness terms like “clean ingredients” and “whole health” that are immediately relevant to savvy pet owners.

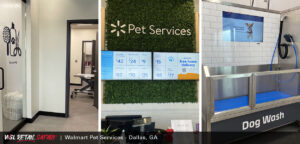

Walmart gets warm and furry.

As Petco likely knows, U.S. consumers spent nearly $144 billion on their pets in 2023, the American Pet Products Association projected. And 43 million pet owners are in the Walmart/Sam’s Club database. So it’s not surprising to use that Walmart recently unveiled its first Pet Services Center, in Georgia. The center provides essential pet services, including veterinary care in collaboration with and the vet care and pet products company PetIQ, grooming and a self-serve dog wash, all of which emphasize Walmart’s commitment to everyday low prices. (PetIQ has rented space for vet clinics within more than 65 Walmart locations, CNBC has reported.) Importantly, the Pet Services Center adheres to Walmart’s commitment to convenience: it’s built in a dedicated store front adjacent to Walmart Superstores, further establishing it as a one-stop destination for the whole family’s health and shopping needs.

Walmart’s also investing in women’s health.

Before it began testing pet health services, Walmart has for years invested significantly in human health centers. In fact, its Pet Services Center is located in the same recently remodeled store where it opened its first Health Center, in 2019. Now, Walmart is targeting its care services to a critical shopper base – women – with its first in-store mammogram screening center, at a location in Delaware. The center, called MammogramNow, is operated by radiology provider RadNet and strives to “break down accessibility barriers including time and money,” a women’s health expert explained in a news report. If the MammogramNow pilot does well, Walmart could incorporate more such preventive features at its other health centers – in 2024 Walmart expects to add 28 Health Centers, for a total of more than 75.

Our scouts will keep you posted.

Addressing the Space Conundrum

Now here’s the challenge: While these service-centered retail locations exist for good reason – consumer need – they each require physical space. So where do retailers put them?

There are options, such as converting back-house storage space into services space, or reducing SKUs in certain categories. Or, as Walmart has done, investing in buildouts adjacent to existing stores.

Each case requires a cost-and-benefit analysis; monitoring sales-per-square-foot trends across categories to more accurately forecast those worth paring back vs. investing in.

It’s risky, and it doesn’t always pay out, but with every test, retailers get better at it. And we’re keeping tabs so we can share the success stories. Stay tuned.

Retailers and brands that want to add new services and experiences should consult an expert that can share what your most innovative competitors are up to. We can tailor a Retail Safari® to meet your right-now, and next, needs.