By Noor Lobad, NOVEMBER 19, 2024 || A Publication of WWD (Women’s Wear Daily)

Gen Z is the only cohort whose beauty spend is growing in units, per NIQ – and the race for their loyalty is intensifying among a growing number of retail players.

The beauty retailer race for Gen Z’s hearts and wallets is heating up.

As more members of the cohort age into their spending power – which will reach $3 trillion by 2030, according to NIQ – the number of retailers vying for their beauty spend, too, is climbing.

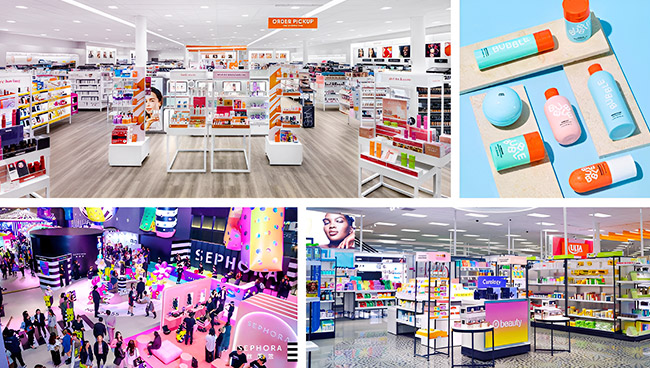

On one hand, big-box retailers like Target and Walmart are betting bigger on the category, bringing buzzy brands to their assortments and, in the case of the former, implementing Ulta Beauty shops-in-shop in more than 500 doors. Digital retailers like Amazon and TikTok Shop, too, are growing at record speed, particularly among young consumers thanks to their respective strengths of convenience and discovery.

Meanwhile, competition between the category’s biggest specialty retailers – Sephora and Ulta – has never been more stiff.

In fact, in 2023 Sephora dethroned Ulta for the first time as Gen Z’s number-one beauty retailer of choice, according to Piper Sandler’s semi-annual Taking Stock With Teens Survey, nabbing 37 percent of share while Ulta garnered 32 percent – a 10 percent drop versus 2022. In the survey’s latest fall 2024 iteration, the effect was compounded, with Sephora again taking the top spot at 36 percent, while Ulta dropped another five points at 27 percent.

But Sephora’s not the only retailer Ulta is ceding Gen Z market share to: At 13 percent, Target gained four points this fall, while Amazon and Walmart both jumped from 5 percent to 7 percent during the same period.

“This isn’t a one-takes-all market,” said Korinne Wolfmeyer, vice president and senior equity research analyst, beauty and wellness, at Piper Sandler. “With Gen Z, what we’re seeing more and more is that they diversify far more than any other generation.”

While data from Circana shows the 18- to 24-year-old consumer tends toward the specialty beauty channel – contributing 1 percent of its sales year-to-date, nearly double the 6 percent share they comprise of the remaining beauty market – value is high priority for the cohort, and data also indicates they’ll take it wherever they find it.

“Budgets are a big concern for this age group, and because this is a savvy consumer that is accustomed to doing their homework and getting recommendations via social media, the outlet becomes perhaps less important than the idea of the product,” said Jacqueline Flam Stokes, senior vice president of beauty, drug and over-the-counter retail at NIQ.

According to NIQ, only 56 percent of Gen Z shoppers have a specific brand in mind when purchasing beauty products, versus 67 percent of non-Gen Z shoppers.

“Searching by ingredient is so huge now – the consumer might go to the store knowing they want a hyaluronic acid serum, but the brand is just less important to them,” said Anna Mayo, NIQ’s vice president of beauty, adding that private label brands have benefited from this shift, ranking as the top “brand” in the mass market by both dollar and unit sales among Gen Z.

“Fundamentally, Gen Z has grownup with lots of choice – and that’s what they choose to wield when it comes to shopping,”

said Wendy Liebmann, Chief Executive Officer of WSL Strategic Retail.

While this makes the stakes for retailer loyalty higher than ever, data indicates there are key nuances in the way Gen Z shops via different channels.

Few know this better than Shai Eisenman, founder and CEO of Gen Z-loved skincare brand, Bubble. Since debuting in 2020 at Walmart, the under-$20 line has increased its door count to more than 10,000, entering CVS Pharmacy in 2022; Ulta in 2023, and Priceline and Boots in Australia and the U.K., respectively, this year.

“We see each of our retailers as a very different trip for the consumer,” said Eisenman, adding that the brand’s core cleanser and moisturizer offerings over-index at Walmart, while treatment products sell more at Ulta and acne care comprises the top-performers at CVS Pharmacy.

“We don’t even see it as competitive, because we show up differently at each retail environment; Walmart is the story about accessibility, Ulta is the story about fun and exploration, and CVS is where we talk more about the clinical side,” Eisenman said.

For Eisenman, “the most interesting thing about Gen Z is they feel like the first generation that doesn’t view price point as a signal of quality – they understand that quality comes at different price points, and at different points of sale.”

It’s an understanding that even a prestige brand like Benefit Cosmetics – which sits at a significantly higher price point than Bubble but has similarly struck cross-channel resonance with Gen Z – is leveraging to its advantage.

“We know Gen Z only buys what they think is worth it – that doesn’t mean they’re predisposed to mass brands or cheaper products – it means they’re value-focused; if they think it’s worth the money, they’ll make the purchase,” said Toto Haba, senior vice president of global omnichannel marketing at Benefit.

The brand was one of the earliest beauty companies to launch on TikTok Shop in the U.S. in 2023, adding the social commerce platform to its existing retailer lineup of Sephora, Ulta and its direct-to-consumer website and brow bars.

“Between Sephora and Ulta, our product mix is somewhat similar, but on TikTok Shop, we see our trending products sell-through much more,” said Haba, pointing to the brand’s hybrid lip and cheek tint, Benetint, as one such oft-trending product on the platform.

For instance, to coincide with a “jelly donut” blush trend the brand spearheaded this summer, Benefit bundled the tint with its High Beam Liquid Highlighter in a TikTok-exclusive kit priced at $35 ($52 value), of which more than 20,000 units have since been sold.

“We’re making sure we’re highly visible where Gen Z discovers beauty and shops,” said Haba, adding that the effort is paying off: “We’re seeing Gen Z spend grow faster than the rate of our total business.”

The trend tracks with that of the industry at large: Even though Gen Z only comprises 9 percent of all beauty spend, it is the only cohort achieving year-over-year unit growth in the category, per NIQ.

For Benefit, a significant portion of the cohort’s spend is coming from Sephora, which shares the same parent company, LVMH Moët Hennessy Louis Vuitton.

“The two retailers that it feels are winning the bulk of Gen Z are Sephora and TikTok,” said Haba, adding that Ulta is “winning them in a different way: its key thing is that high-low assortment, which Gen Z really gravitates toward.”

Ulta is also Benefit’s exclusive partner for its brow bar services, which “attract a slightly older clientele than our product-only mix.”

Said Haba: “One of Sephora’s key strengths in converting Gen Z shoppers is that it’s so highly visible on social. It made a massive commitment early on to engage with the creator community and build the Sephora Squad, and that has given them this leg up in the space.”

Indeed, data from Tubular Labs and Gen Z research firm Dedx shows that engagement of user-generated TikTok content mentioning Sephora nearly quadruples that of content mentioning Ulta, with Sephora garnering 1.8 billion engagements from 2022 through 2024, versus Ulta’s 506 million.

This is a significant shift from 2020 through 2022, when the retailers netted near-identical engagement levels of 295 million (Sephora) and 294 million (Ulta).

Data from CreatorIQ, too, shows that in comparison to Ulta, Target, Walmart and Amazon, Sephora took the top spot by year-to-date TikTok earned media value growth at 32 percent. Walmart came in second at 23 percent growth, followed by Ulta at 16 percent while Target and Amazon saw respective 15 percent inclines.

With that being said, Amazon (including its non-beauty offerings) takes the top retailer spot by total TikTok EMV, with TikTok Shop trailing in second place and Sephora in third.

In terms of why Sephora indexes so highly on TikTok, “It’s mainly a volume thing – there’s a greater prevalence of Sephora-specific content versus Ulta-specific content,” said Alex Rawitz, CreatorIQ’s director of research and insights, adding there is an indication that Sephora “has kind of permeated pop culture, or the zeitgeist, to a greater degree than Ulta.”

Beyond social savvy, Sephora was also a first-mover with Gen Z-favorite brands like Rare Beauty, Charlotte Tilbury and Sol de Janeiro – the latter two which have more recently entered Ulta as well.

But even the retailers’ shared brands tend to tag Sephora in social content more often than they do Ulta. For instance, Fenty Beauty drove $20.4 million EMV for Sephora this year via its owned channel versus $14.9 million for Ulta. Sol de Janeiro drove $7.1 million EMV for Sephora versus $2.8 million for Ulta during the same period.

“Sephora is kind of a feedback loop; it’s growing because it’s where the brands that you want to talk about are, and those brands, in turn, are growing because Sephora can act as a megaphone for them and amplify their message,” Rawitz said.

This matters because, as Flam Stokes put it: “There’s a direct correlation between the basket size for Gen Z and the size of the social outreach related – whether that be the size of Ulta’s following, Sephora’s following, or even Target or Amazon’s, and how much investment they’re putting into their influencer and social media pushes.”

When it comes to TikTok Shop – which went from being the ninth-largest beauty retailer in the U.S. in the spring to permeating the top-five this fall – categories seeing the most traction include facial skin care, hair tools and accessories, fragrance and eye makeup, particularly faux lash clusters, per NIQ.

About 17.1 percent of the platform’s shoppers are in the 18 to 24 age group, versus 13.7 percent at Ulta and 12.3 percent at Sephora. Lower-income and Hispanic consumers also over-index on the platform, where the average price point is “under $20 – so it’s really that impulse-purchase zone,” said Flam Stokes.

Leslie Ann Hall, founder and CEO of TikTok Shop’s first beauty agency partner Iced Media, said the platform is primarily being used as a discovery channel, and not so much a replenishment channel – meaning it isn’t cannibalizing brands’ other retailers.

“We’re actually seeing a halo effect, where if a brand is trending on TikTok Shop, they’re going to see an uptick of sales for that same product at Ulta, Sephora, Amazon, and their own e-commerce channel,” said Hall, who has brought brands including Dieux, Moroccanoil and more to the platform.

“It remains to be seen what loyalty looks like on TikTok Shop, but we are seeing that it’s very disruptive in terms of consumer dollars,” said Flam Stokes.

Meanwhile, Amazon, a longtime replenishment channel thanks to its convenience and speed, is gaining share as a discovery channel specifically among Gen Z, according to Melis del Rey, Amazon’s general manager of U.S. stores, beauty, baby and beauty technology.

“Gen Z’s mode of exploration is through trend-led search,” said del Rey, pointing to K-beauty and skin care’s “beef tallow” craze as recent trends that have fueled searches and subsequent sales on Amazon.

The platform has added more than 300 beauty brands on Amazon so far this year, including several in The Estée Lauder Cos. family such as Dr.Jart+ and Too Faced, as well as buzzy indies like Topicals and Prados Beauty.

“As TikTok Shop and Amazon continue to get more brands on their platform, there’s not going to be just one winner,” Wolfmeyer said. “Sephora and Ulta will likely continue being the top two (retailers] among Gen Z, though they may alternate positions depending on the year and what’s going on with the various brands they’re carrying, but you’re going to see the margins start to shrink – Walmart is going to step up a bit, Amazon is going to step up a bit, and so on.”

Added Liebmann:

“The thing to remember about Gen Z is they’re not one monolithic group: they have nuances, and even if your target audience is not Gen Z, there’s a lot to be learned from the brands and retailers which are doing well with that audience.

Their core issues of caring about value, the right product mix, feeling included in the conversation – those are becoming more important for consumers of all generations.”

Visit WWD for the full article.