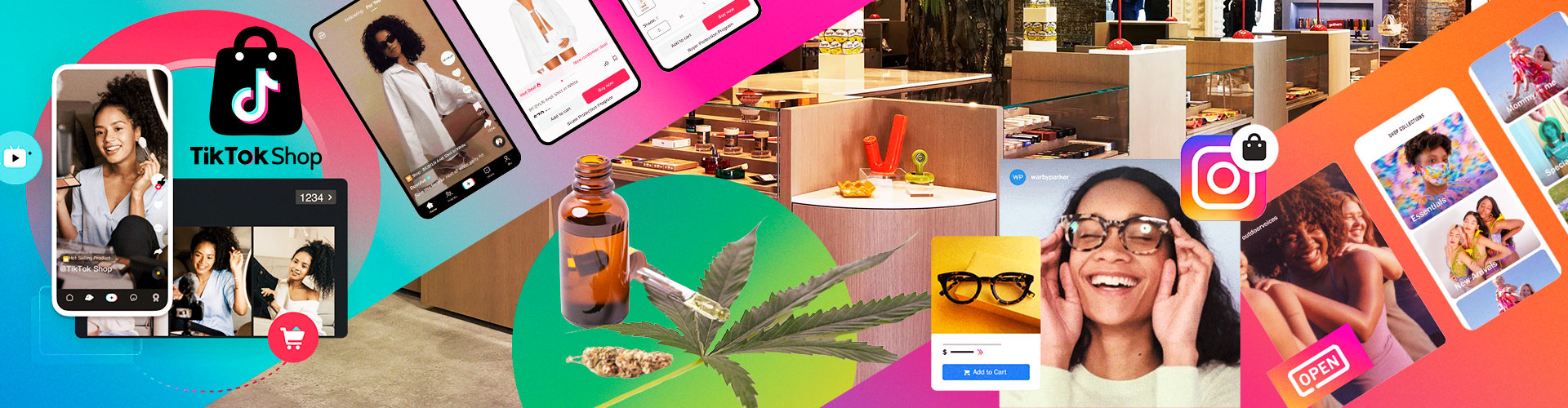

Under-the-radar retail channels such as TikTok, Instagram and marijuana dispensaries are eating up market share in the health and wellness category, our preliminary How America Shops® research suggests. If retailers and brands don’t respond to this threat soon, they’ll suffer the side effects. But we see opportunity.

Invisible Channels are Rerouting Established Retail Paths

From TikTok and Instagram video feeds to legalized marijuana dispensaries, emerging forms of retail channels are siphoning off sales from traditional shopping outlets. And these “invisible” routes are poised to capture visible market share.

Why not, when millions of Americans are spending more time with such channels? TikTok counts more than , and they spend an average of nearly one hour a day on the social media platform (up from 27 minutes in 2019). Meanwhile, more than 100 million people in the U.S. watch Instagram Live video feeds every day.

And 74% of Americans now live in a state where marijuana is legal for either recreational or medical use, Pew Research reports. As of early 2024, nearly 15,000 marijuana dispensaries operated in the U.S. Not surprisingly, Statista predicts the U.S. cannabis market to climb to $50 billion by 2029, from $43 billion in 2024.

These “Niche” Routes are Poised to Invade Mass Categories

Here’s the real threat – or opportunity – for traditional retail outlets: These uprising channels are poised to capture sales in the burgeoning health and wellness categories, where brands and retailers are investing sizeable sums.

For example, we’re already seeing a looming threat – or opportunity – in the wellness and vitamin categories. More than 40% of Gen Zers and 55% of Millennials – leading users of TikTok, Instagram and marijuana dispensaries – take vitamins or supplements regularly, according to our How America Shops® report, “Shoppers’ View of the Future of Health.”

And 50% of all consumers in our survey told us they believe marijuana and CBD contribute to overall wellness.

So It’s Logical These Wellness Categories and Channel Paths Will Cross

In short, these “invisible” channels are slowly rerouting established retail paths. If shoppers start buying vitamins on TikTok or seeking stress relief at marijuana dispensaries, it’s a threat to traditional channel and category sales.

For context, consider these findings from our How America Shops® research:

Retailers and Brands Have the Resources to Compete

WSL is soon going to survey shoppers on which categories they are willing to buy from TikTok, Instagram and Snapchat. Until then, we have three suggestions for retailers and brands as they plan their category marketing:

1. Use information to gain trust among marijuana shoppers.

Rather than trying to go head-to-head on price and promotions, brands and retailers can gain trust by building strategies regarding the effectiveness, reliability and safety of their brands. Education about the safety of over-the-counter products for sleep and pain can be especially valuable.

2. Offer mental wellness support from social platforms.

Research suggests that Instagram and TikTok contribute to anxiety, depression and addictive behaviors. Brands and retailers can get in front of this challenge by offering products that serve as stress-relieving alternatives to social media. They can even promote mental wellness on social media platforms and become a resource to potentially anxious users.

3. Recognize the divide between the “haves” and “have-nots.”

Most consumers want to live a healthier life, but the cost of it can be out of reach for many. In fact, 72% of shoppers told us they prefer to live healthy in ways that don’t cost money. Retailers and brands can capture this majority with non-premium products and services, many of which already exist but are not promoted for wellness. For example, drugstore chains can introduce endcaps or aisle sections dedicated to small-sized, affordable medications.

Retailers and brands need to follow how their customers shop these channels, before the “invisible” erosion they cause becomes evident. The good news is we’re already tracking them, and we will continue to.

Now’s the time to turn a potential threat into an opportunity. Stay tuned.

WSL follows the shopper into new categories and channels all year round. If you’re interested in tailored research for your channel or category, or are trying to better connect with a specific consumer group, contact WSL’s consulting group here.