Today’s average household is leaning toward a new population of Hispanics, Boomers, multigenerational dwellers and singles. What retail channels do these demographic segments prefer to shop, and which retail brands? We dug into our 2024 How America Shops® population survey to find out.

Are You Merchandising for These New Consumer Households?

Forget about the “nuclear” family. In 2024, the typical household is better described as the “new” American family. Consider these seismic demographic shifts that define today’s American home and will require adjustments to your marketing strategy.

- Single people occupy nearly 29% of U.S. homes, representing about 38 million solo households, the Census reports. Nearly 7 million people younger than 65 live in single households.

- Trendsetting Boomers who accepted new categories and signed on for digital tools (never to be left behind the newest trends) now represent more than 17% of the population. And every day an additional 12,000 people turn 65. By the end of 2030, all Boomers will be older than 65.

- One in five people live in a multi-generational households, formed in part by adult children putting off marriage and not moving out. According to U.S. Census reports from 2021, 33% of consumers ages 18 to 34 lived with their parents. Senior adults moving in with their kids represent the other factor.

- The US birth rate is driven by Hispanics. One in four U.S. children identify as Hispanic, revealing a higher birth rate among this population – 41%, compared with 36% of Caucasians.

These different households generate a new mixed bag of shopping needs and preferences, and the changes are unfolding rapidly across retail.

These Seismic Shifts Require New Retail Strategies

After completing our 2024 How America Shops® study, “Seismic Population Shifts,” we were struck by the extent to which the changes in American households influence retail and product choices. Here’s what we found.

The New Consumer Path: Where 4 Populations Shop Most

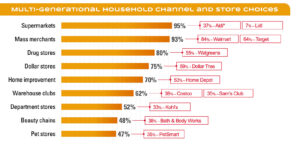

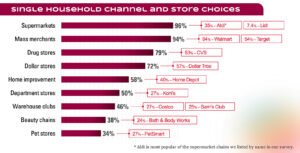

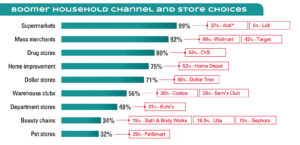

We recently asked shoppers to tell us which channels they purchased from in the previous three months, and which retailers they chose within each channel. Here they are cross-referenced by demographics across nine channels.

The first figure references the percentage of each household that shops the channel, followed by selected retailers. Many stores known for competitive prices pop up repeatedly. Brands should be sure they products are on the shelves in these retailers.

4 Population Behaviors You Need to Know to Develop a Shopping Strategy

Our research also surfaced behavioral findings from our How America Shops® report. They offer valuable insight into how to planogram stores and promote categories.

1. Multi-generational frugality will continue.

Households that span generations are less optimistic about their financial futures than solo households – 44% are pessimistic, vs. 36% of single person households. It’s likely then that these consumers will continue to be cautious spenders because they have so many mouths to feed as well caregiving.

![]()

Imagine a household with younger adults hanging around and older adults who need care moving in. This is a high-stress environment for even calm shoppers. How can you make their trips more affordable and easier?

2. Expect the unexpected from Hispanic consumers.

Hispanic shoppers are the least likely of any population we tracked to stick to a shopping list. This may be due to having more children, which introduces unplanned purchases, and they focus on their pets (12 to 26 percentage points more than other households).

![]()

Customize convenience for this child-rich, pet-rich, busy population. For example, Hispanic consumers are more likely to have food delivered, even if it costs more, because they simply don’t have the time to pick up the pizza.

3. Mass merchants are frequented more than supermarkets.

While 95% to 99% of these four populations shop supermarkets, they visit big box stores like Walmart and Target more often.

![]()

Mass merchandisers attract 58% of their shoppers weekly, compared with 50% of shoppers at supermarkets. Nearly 40% of consumers say they shop Walmart more now than a year ago; 29% shop Target more often. What reasons can supermarkets use to entice these frequent shoppers to come back to their stores weekly?

4. Diverse households shop the dollar channel more.

Twice as many shoppers visit dollar stores more often, vs. less often, than a year ago. Four in 10 hit the channel weekly.

![]()

Dollar stores attract consumers for value. Retailers could benefit from having their own dollar sections (like Target’ Dollar Spot or Bullseye’s Playground). Brands can ensure they are on the shelf in the dollar channel.

You Can Keep Pace with Your New Population. Let Us Help

Your consumer households are changing from what you know and require a different shopper and retail strategy. How will you anticipate these shifts to ensure brand and retail growth? Learn more on these upcoming population that are reshaping strategy in our report, Seismic Population Shifts. To learn more about our consulting services, click here.