Welcome to the new American household, with fewer kids, more singles and a LOT of Boomers. The traditional U.S. home is undergoing dramatic changes, but how is it playing out in the shopping trip? We used our How America Shops® research to learn how these changes are playing out across several categories.

Are Retailers and Brands Missing a Singular Opportunity?

Nearly every other American adult, 46%, is classified as single, according to U.S. Census Data. Fewer, just 40%, have children in the household. As a result, consumer preferences at retail are changing, but not in ways we might predict. Consider these stats:

- Solo-person households now represent 29% of the total, with nearly 38 million, the Census reports.

- It’s not just young Gen Z and Millennials going it alone; the amount of single-person households occupied by 35- to 64-year-olds is equal to that of those older than 65 – roughly 16 million each.

- The number of those older consumers, single or not, is booming: Roughly 17% of U.S. population is now older than 65. And every day, another 12,000 people turn 65 – and will do so for years.

And guess what all these single, and typically older, households don’t do? They don’t think about supporting a family. They’re thinking about themselves.

This is playing out in shopping patterns across retail categories. How well are retailers and brands strategizing for this opportunity ?

The New Population Is Shopping Differently. Here’s How

We combed through our How America Shops® consumer surveys to see which categories are most affected by these population shifts, therefore presenting the biggest opportunities for brands and retailers.

This is what we learned:

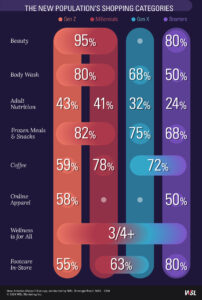

- Beauty: Nearly 95% of Gen Z and Millennials shop beauty, but 80% of Boomers do as well, and their years of experience makes them certain about what is best for them and most flattering. It takes smart marketing to lure them to something new.

- Body wash: About 80% of Gen Z and Millennials buy these products, compared with 68% of Gen Xers and 50% of Boomers. Is this category waiting to be made ageless?

- Adult nutrition (aka know as protein in a bottle): Surprisingly, more Gen Zers buy these products than any other age group: 43%, followed by 41% of Millennials, 32% of Gen Xers and just 24% of Boomers. This is a category where a burst of energy appeals to anyone over 50!

- Frozen meals and snacks: Roughly 82% of Gen Z and Millennials shop frozen meals and snacks (81.5% and 82.7%), compared with 75% of Gen Xers and 68% of Boomers.

- Coffee: 59% of Gen Z bought coffee, while 78% of Millennials and 72% of Gen X and Boomers did. This is one category that will benefit from an aging population.

- Online apparel. While Gen Z are (predictably) the most likely age group to buy clothing online so do Boomers, a surprising 50% of Boomers buy their clothes online[1].

- Wellness is for all. More than three-quarters of all generations buy wellness categories, starting with vitamins and supplements (which skew toward Boomers).

- Boomers make the most in-store foot traffic. Nearly 80% of Boomers purchase foot care products in a physical store. That compares with just 55% of Gen Z and roughly 63% of Millennials and Gen X.

Regardless of category, older shoppers are less stressed about spending: 84% of all consumers feel financially pressured, but the figure drops to 74% of Boomers, according to our report, “Caution! Retail Curves Ahead.”

Follow Behaviors. Not Preconceived Stereotypes

What these findings prove is that in addition to shifts in how U.S. household are made up, the predictable behaviors of their members are changing.

- Women’s wellness is maturing earlier than you might think. 25% of Gen Z and Millennials search for information on menopause, while Gen X is right in the middle of menopause, so the percent doubles among this group.

- Men’s wellness is maturing earlier than you might think, too. Almost half of Millennial and Gen Z men want information about prostate health, compared with one in four among Boomers and Gen X men.

6 Shopper-Inspired Steps to Reach More Households

Retailers and brands can get in front of all of these consumer segments with these shopper informed insights from our research.

- Offer information and product solutions for a broad range of ages. Consumers want to look good, and feel good, at every age, and prevention is on the minds of younger generations.

- Merchandising in the beauty aisle. Not just products, but imaging and language should be relevant to women of all Same goes for the men’s health and grooming categories.

- Market to tomorrow’s Boomers today. By 2050, the share of consumers older than 65 is projected to represent 63% of the total population, reports the Population Reference Bureau. In the interim, 12,000 Gen X are becoming Boomers daily. Retailers and brands should gain relevance with these shoppers by anticipating their “tomorrow” needs and gently promoting them (and be sure to include beauty).

- Don’t ignore the “ageless” wellness categories. Vitamins are universal, and certain conditions simply don’t see age: think thinning hair, skin care and joint pain. In each of these sub-categories, vitamins offer a solution, from strengthening bones to improving immunity to hormone replacement.

- Ensure personal care is personalized online and in the store. Because Boomers are much more likely to shop personal care in the store, while young consumers do so online, the positioning and marketing of these items should reflect that. Foot care is a Boomer category and should be placed on shelves that are easy to see and reach. Thinning hair is more ageless and presents an opportunity for new product launches from established brands.

- Acknowledge all the adults who live with adults. More than half – 56% – of adults ages 18 to 24 live with their parents, the Census reports. These consumers are likely looking for items that support independence, such as mini-refrigerators or food container labels, but not big-ticket home furnishings. Parents could be on the lookout for noise-cancelling devices and chore calendars.

Keep Up With Your Consumer Households

How are your shoppers navigating traditional and emerging categories? WSL tracks shopper behaviors by age group across dozens of relevant product categories. To learn more about our consulting services, click here.