Retailers and brands are talking more about the demise of channels as shoppers get whatever they want, when and wherever they want. This behavior is not new, but its imprint is beginning to show profoundly, with many retailers struggling to remain relevant. Is the power of the consumer, as in “branded touchpoints” the answer?

It’s Time to Focus on Shoppers, Not Channels

Consumers don’t spend a lot of time thinking about where their food, wellness care or beauty products come from when they need them, and it’s been this way for years. Yet so many retailers and brands still distribute through the lens of channel, when they should see it through the lens of the shopper.

They do this at a risk, because consumers are forcing retailers to adapt. A number of retail segments, such as drug, are struggling to remain relevant as shoppers turn to alternate options, including everywhere-all-at-once e-commerce. And as a result, we’re seeing more and more examples of retailers and brands recalibrating their distribution strategies from traditional channels and formats to shopper moments, or “branded touchpoints.”

As described by the specialized consumer behavior-and-technology venture fund XRC Ventures, we’re in a world where “every point of human contact is a commerce channel.”

In this world, retailers and brands shouldn’t be building distribution strategies for categories, formats and segments; they should be building for shoppers. They need to ask: Am I missing where my shoppers are and where my growth opportunities exist?

Shifting Retail Focus to Shopper Focus

Think about it: It used to be that brands had the power through media, influence and centralization. Then retailers had it through the power to insist. But now (to paraphrase James Carville), “It’s the shopper, stupid.”

Or, as we at WSL Strategic Retail put it: To see the future of retail, you need to see the whole story, not just your channel or category. And to do that, you must follow the shopper. Because the shopper’s inclination to buy whatever, whenever makes it more complicated for manufacturers to rely on channel strategies for efficiency and management (thanks in no small part to the role of e-commerce).

Even when manufacturers do get beyond channel, they limit their focus to their top five or six retail customers and bundle the rest. So they focus on maybe Walmart, Costco, Amazon, Kroger and CVS and group regional grocers, dollar stores, convenience stores, etc. into sub-channels.

In doing so, they may lose the growth opportunity that is the power of the consumer. And these growth opportunities are less predictable today.

The bright spot is recent innovations suggest that the retail format (or channel, for that matter) is reviving in more touchpoint-focused forms, combining physical and digital. And for good reason: An omnichannel shopper spends, on average, $1,043, while an in-store-only shopper spends $839, and a digital-only shopper spends $857, according to Grocery Doppio.

This Shift Is Not New, But It’s Timely

These insights make it clear for retailer and brands: Stop conducting business through the lens of channel. Think of ways to reach the shopper across moments that can be transformed into branded touchpoints.

Three principles are fundamental to doing this:

- Broaden shopper data – When considering the white space of opportunities, such as a new product or category to grow, incorporate the competitive landscape into the data set. Much of retail data collected is limited to the one retailer, when it should include other places where the shopper spends.

- Plan for an unplanned path – Designing a sales strategy based on the old-school structures of segment and category – what is our drug strategy, online strategy, club strategy? – is too rigid for today’s shopper behavior. These old structures fail to follow the path from the shopper’s point of view.

- Look behind your customers – Remember: The shopper isn’t necessarily the end consumer.

How Retailers are Adapting the ‘Shopper Commerce Channel’

Below are examples of retailers and brands applying the above principles to touchpoint-focused distribution experiences.

In Grocery…

The regional chains Wegmans, Sprouts Farmers Market and Buc-ee’s, among others, are tailoring some of their stores to individual markets. Buc-ee’s, for example, is positioning its very large stores as tourist destinations, Progressive Grocer reports. Sprouts is building smaller-format stores intentionally designed to cater to urban shoppers and those on the “urban periphery.” (Sounds like a micro-market worth targeting.) And Wegmans in April relaunched it mobile app with advanced AI features to deeply combine personalized online and in-store experiences.

In Mass Merchandise…

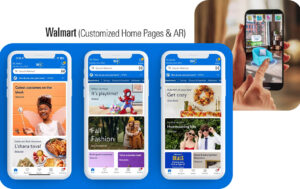

Walmart in 2024 pioneered a platform combining AI, machine learning, and augmented reality to intuitively interpret and respond to shopper needs online and in all stores, including its Sam’s Clubs. Walmart described in a press release: “Walmart will create a unique homepage for each shopper making the online shopping experience as personalized as stepping into a store designed exclusively for each customer.” Part of this strategy includes a pilot of immersive commerce partnerships in which customers can purchase goods for their virtual avatars, and themselves – a clear aim at distributing for younger consumers.

In Department Stores…

We’re literally taking French lessons on how to see distribution through the lens of shoppers at the new Printemps flagship in New York City. As described in our recent Retail Safari®, the store focuses on social experiences, not departments or categories, as the channel. The flagship’s winding, sensorial paths guide visitors to a raw bar, a champagne bar and restaurants, while breezing through roomlike showrooms. These “rooms” include the “Boudoir” (women’s fine fashion), the Garçonniére (men’s fashion), the Playroom (for children), the Sneaker Room, the Apothecary and the Salle de Bain (beauty). Très chic.

In Beauty…

Clinique, the department store mainstay, has followed its customers outside the department stores and is meeting them elsewhere through a multi-faceted, multi-format approach that includes Ulta and Sephora (and Kohl’s locations that partner with Sephora). Clinique in 2024 also debuted in the Amazon Premium Beauty store, the first of a select few Estée Lauder brands to do so. By following the shopper into these new placements, and not being held back by old policies, Clinique can meet a wider range of shoppers at different times, not just when they make special trips to the department store. In doing so, Clinique provides an apt example of shifting the distribution from fulfilling stores to fulfilling customers.

In Drug…

The drug store segment is shaking up. Rite Aid is shuttering more than 300 stores after filing for Chapter 11 bankruptcy protection again, Walgreens is in the process of closing 1,200 locations, and CVS is approaching 1,100 closures. The struggle stems in part from low reimbursement, negotiating lower costs through pharmacy benefit managers, and prescription competition both online and in grocery, mass and club. The challenges also are due to weak retail sales at the front of the stores. However, while the overall drug “channel” may be overcoming issues, the easy-access neighborhood drug store still serves a viable role. CVS, as part of its turnaround, in March said it will open about a dozen stores that include only a pharmacy. At half the size of its traditional stores, these strategic locations will cost far less to operate and help eliminate the expense of shrink and theft.

It’s time to explore the unavoidable phenomenon of human touchpoint as channel. What’s next? Follow the shopper to see the future with us. It’s all we do.

Ready to Adapt Your Channel Strategy?

Challenging times drive retailers and brands to test new strategies, but it’s important to be mindful of who you are in the process. For a tailored consultation on how to find your white space opportunities across all human touch points, contact WSL Strategic Retail here.