In this report we wanted to investigate the links between Trust, Loyalty, and Caring to see how they work together and help identify ways for brands and retailers to better leverage them to win. We also wanted to better understand the relationship between price and quality across categories to uncover ways to motivate shoppers to buy mid-priced brands, especially when trading down seems to be more common than ever.

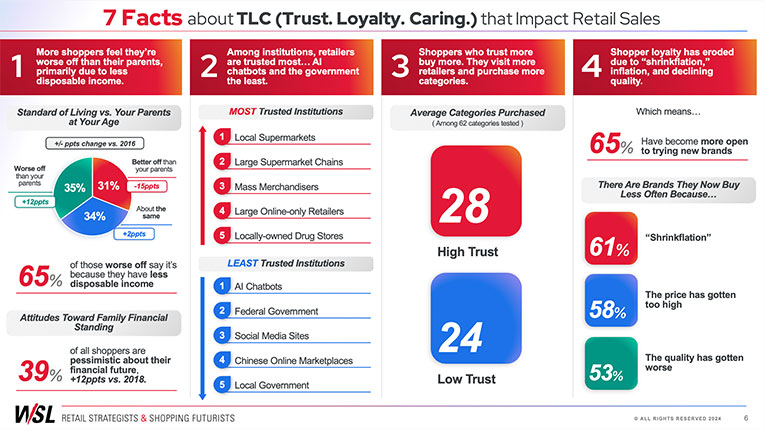

- We saw that more shoppers feel they are worse off than their parents at a similar age (+12ppts since 2016), primarily due to less disposable income. This is just one contributor to a rise in shopper pessimism about their financial outlook.

- We measured shopper trust across institutions and found that retailers topped the list, beating out others we rely on every day, such as news, banks, cell phone providers, social media and government.

- In our quest to dig deep into Trust, we identified some important differences between high and low trust shoppers. Shoppers who trust more buy more categories and shop more retailers, underscoring the importance of building trust to deliver growth.

- We found that shopper Loyalty has eroded due to “shrinkflation,” inflation, and a perception of declining quality. As a result, shoppers are more open than ever to trying new brands. This represents both a risk and an opportunity.

- Our retailer Caring scores are reported and compared back to our last look in 2022.Spoiler alert! Newly included Trader Joe’s beat the pack and won 1st place.

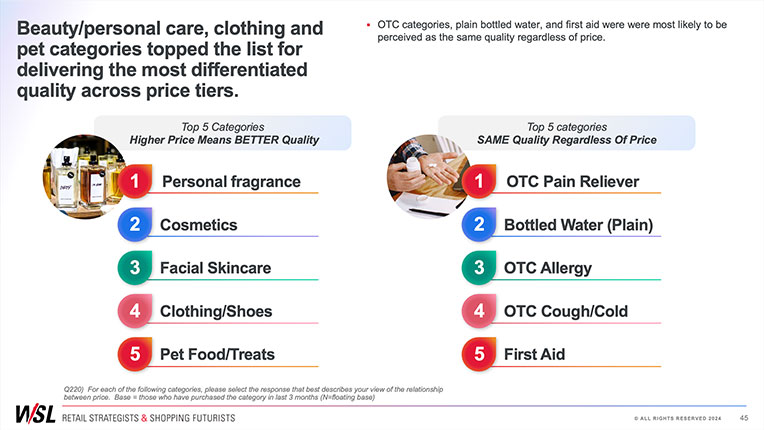

- Finally, we explore the relationship between price and quality across categories and uncover shopper attitudes and beliefs that motivate them to buy mid-priced brands in what we lovingly coined “the messy middle.”

Despite the challenging environment, there are clear ways to build Trust, Loyalty, and Caring to positively impact future sales!

About this report: This report is the third report for 2024 that is part of the How America Shops® shopper insight series. The sample is a national online survey of 1505 household shoppers, and the survey was conducted in September – October 2024.

If you are a subscriber, you can access the report by signing into your account.

If you are not a subscriber or would like to purchase this individual report, reach out to our Director of Insights, Debbie Kelly, through the form below!

Our latest shopper insights – at your fingertips

Our national How America Shops® surveys explain what’s driving shopping behaviors, sentiments that influence how and where shoppers spend time and money what engages them emotionally, how categories and the retail landscape will be impacted.