Generation Alpha – kids born between 2010 and 2024 – are estimated to be worth $255 billion as consumers. And they influence a significant amount of their Millennial parents’ brand choices and household spending. But don’t expect Gen A to simply be an extension of Gen Z. These four factors will help brands and retailers gain relevance and loyalty among this importantly different generation.

Don’t Let Their Age Fool You, Generation Alpha are Wise.

The oldest members of Generation Alpha might be turning just 16 in 2026 but based on some of their most defining beliefs and personality traits, they can teach retailers and brands a thing or two.

For starters, just look to the nearly $255 billion in spending power this young generation of budding consumers influences. Gen Alpha, born between 2010 and 2024, might not yet have credit cards or cars, but they have been shaped by historic conditions. And those conditions make them different from even their slightly older Gen Zers in noteworthy ways.

Retailers and brands would do well to see these differences. We’ve identified here four characteristics that distinguish this insightful consumer based on our own findings studying Generation Alpha, our Retail Safari® observations, and national studies into the group.

And, as always, we’ve added our How America Shops® insights to suggest how retailers and brands can appeal to and engender loyalty with Generation Alpha early on.

Yes, Generation Alpha Spends Money.

On average, each Gen Alpha shopper spends about $67 a week, according to research by market research YPulse. Seven out of 10 of their parents say they influence regular household purchases, and not just of popular kid categories such as snacks and toys, but of adult categories including beauty and apparel. (Lululemon and Sephora are among brands Gen A talk about with their parents, the BBC reports.)

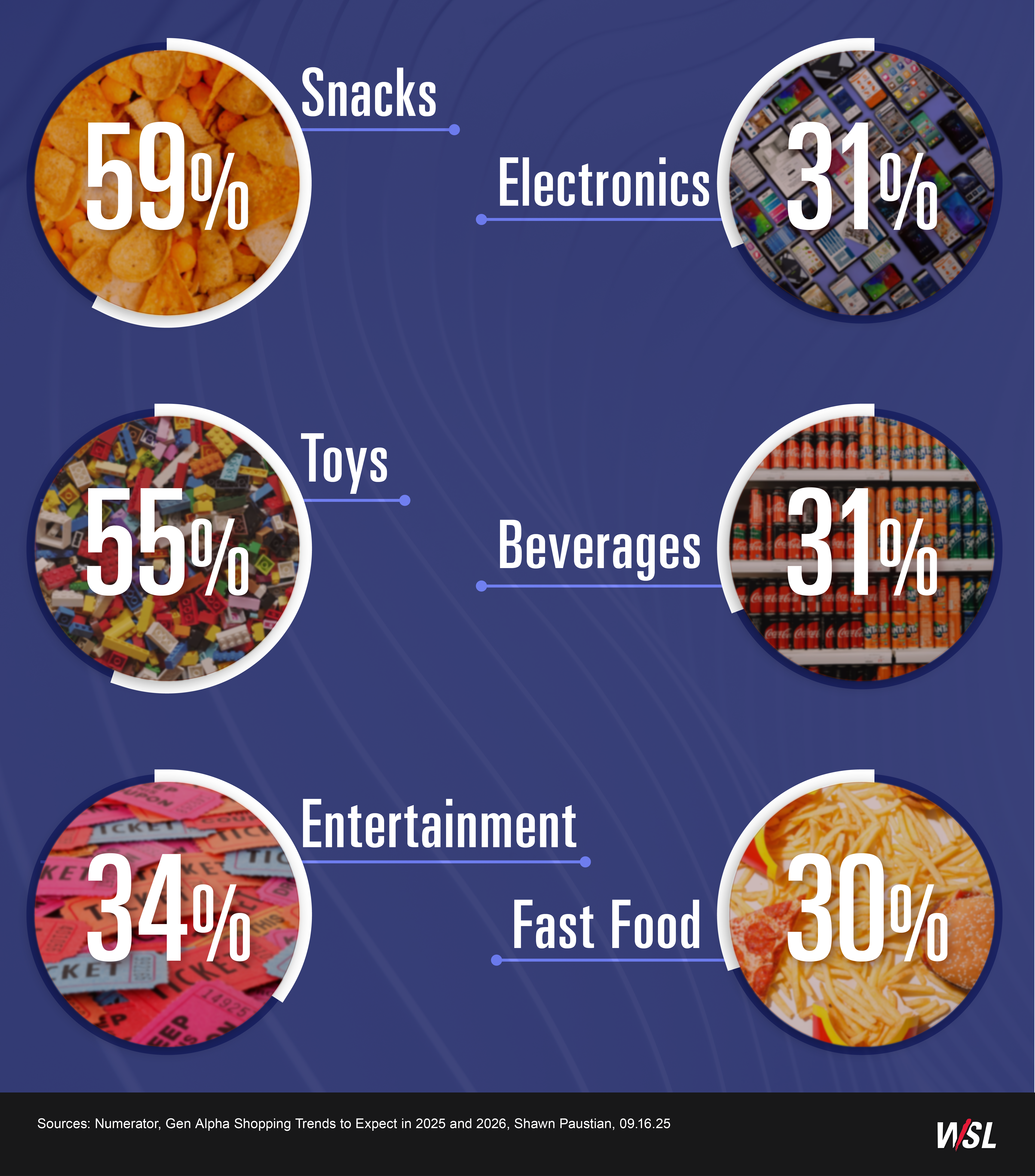

Here’s a breakdown of where Generation Alpha spends that average $67 allowance, according to Numerator:

4 Factors that Explain How Gen Alpha Make Purchase Decisions

Retailers and brands can use the above spending preferences to anticipate how Gen Alpha’s consumer behavior will evolve. But context is an important element of that evolution. These four consumer characteristics of Gen Alpha provide that context.

Even the youngest of Gen Alpha exert influence over their parents’ shopping choices, but that influence can be reciprocal. An estimated 80% of Gen A’s favorite U.S. brands overlap with their Millennial parents, for instance, and those parents say their kids affect 87% of their brand decisions, according to a 2025 survey by Teneo. The root of that effect, however, is a little blurry. Parents might be swayed by their own desires to protect their children from harsh chemicals or gender biases, and not by a spoken preference by their kids. Gen Alpha, meanwhile, might campaign for products by simply repeating what they know is important to their parents.

![]() Be the middleman and alert members of Gen Alpha about a product’s benefits, so they can talk to their parents. The trick is appealing to both generations at once with equal relevance. Take the niche product BoneBuddy, a wearable medical apparatus for broken bones in children. It’s embedded with technology to monitor healing in real time (appealing to parents) and comes with customizable accessories such as superhero wings (appealing to kids).

Be the middleman and alert members of Gen Alpha about a product’s benefits, so they can talk to their parents. The trick is appealing to both generations at once with equal relevance. Take the niche product BoneBuddy, a wearable medical apparatus for broken bones in children. It’s embedded with technology to monitor healing in real time (appealing to parents) and comes with customizable accessories such as superhero wings (appealing to kids).

Members of Gen Alpha can be surprisingly thoughtful about the products they consume, even snacks, and they do not want to be ignored. This explains in part why Gen A’s voice guides 48% of U.S. spending, according to Teneo, including in categories such as beauty and personal care, where they Influence $28.7 billion in spending. These shoppers stick up for their preferences and voice their opinions to their parents, often with information to back themselves up.

![]()

Talking to Gen Alpha means listening to Gen Alpha. Identify what attracts these young shoppers to a brand or product – the cute television ad, for example – and reach out to them through it. Advertisements and social media can, for example, promote brand qualities such as educational benefits, which can inform young opinions and win over their parents. Disney’s practice of embedding entire cottage industries in entertainment is a good template from which to model. A series of TV ads (or video streams) can play out like a miniseries with characters singing the values of a non-gender biased toy or tween-focused hygiene. If parents don’t see the ads, their kids will likely share the information.

It’s not just residual pandemic panic and economic upheaval. Tech-enabled isolation and over-structuring has made for an anxious Gen Alpha. Think about it: Every hour is scheduled in the family-shared digital calendar and AI-fueled smart speakers answer all questions. Further, our 2025 “How America Shops® in Chaos” report shows households with children under 18 struggle to financially meet all of their needs. No wonder 16% of Gen A were diagnosed with mental, emotional and developmental problems in 2023, according to the Annie E. Casey Foundation.

![]()

Companies can communicate that kids do have power to choose what’s right for themselves, as well as provide experiences that build their confidence. Look to the ear-piercing brand Rowan for inspiration. As one of our retail experts experienced firsthand with her daughters, Rowan has elevated the kiosk piercing experience into a comforting, white-jacket setting with licensed nurses and medical-grade materials (no piercing guns!) – all in a discreet, cheerful environment. This transformation should resonate with Millennials who recall a more public, hurried right-of-passage and want something more positive for their kids.

Having held smartphones in their dimpled fists since they were in strollers, Gen Alpha is hungry for physical contact, and context. This includes the experience of in-store shopping, from arriving at the door to exploring for surprises inside. Three-quarters of Gen Alpha say they like shopping physical stores, even with their parents. Retailers and brands are at an advantage here: Gen Alpha’s social options outside of school activities are limited and they do not have credit cards to shop online.

![]()

Establish loyalty among Gen Alpha by architecting surprising store experiences that intentionally appeal to their interests. Show they are seen, and retailers and brands will gain habit-forming trust. Our Retail Safari® scouts saw this firsthand at Miniso, which uses teen-themed characters (Lilo & Stitch, Harry Potter) to tie categories together in an expressive, “we get you” way. Also, promote small-bill purchase opportunities to encourage parents to give their kids cash and build responsibility: 53% of 15- and 16-years-olds receive allowances of more than $100 a month, EMarketer reports.

See How Demographics Matter Across All Shopper Cohorts